Corporate Tax on Intellectual Property in Free Zones

Background

As per Ministerial Decision No. 265 of 2023, Companies registered in a Free zone in UAE can avail 0% tax benefit on the Income derived from patents, software or any approved functional right, etc. (i.e. Qualifying Intellectual Property). Companies are required to maintain Adequate Substance in a free zone and can outsource the research and development activity to third parties in the UAE or Non-Related Parties outside the UAE.

Let's discuss this in detail:

- What is Qualifying Intellectual Property under UAE Corporate Tax Law?,

- Conditions for availing 0% tax benefits for income derived from Qualifying Intellectual Property,

- What is Qualifying Income from Qualifying Intellectual Property?

What is Qualifying Intellectual Property?

Qualifying Intellectual Property refers to patents or Copyrights (registered in UAE or granted under foreign jurisdiction) or any other functionally equivalent right that is approved (such as Orphan Drug, any right protecting plants and genetic material).

This specifically excludes trademarks or any such intellectual asset which is used for marketing.

Conditions for availing 0% tax benefits for income derived from Qualifying Intellectual Property

First, a Free Zone Person shall maintain adequate substance in the Free Zone in which the company is registered. Adequate Substance means the company should have adequate employees, adequate assets, and operating expenses in the free zone to generate income from core income-generating activity (say R & D activity).

However, one exception is provided for intellectual property; research and development activities can be outsourced to third party or non-related parties outside UAE provided the Company is maintaining adequate supervision over such outsourced research and development activity.

Second, the company should derive Qualifying income from Qualifying Intellectual Property (which is discussed in detail below).

Third, the company should conduct all the transactions with related parties at Arm's Length and should maintain Transfer Pricing documents.

Fourth, the company should get the financial statement audited.

What is Qualifying Income from Qualifying Intellectual Property?

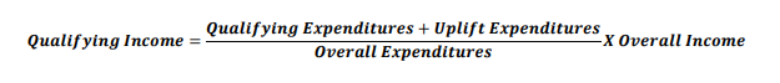

As per the Ministerial Decision No. 265 of 2023, Qualifying Income from Intellectual Property shall be calculated with this formula -

➤ Qualifying Expenditures: This could only include direct costs incurred for Research and Development, including such as salaries, supplies, and overhead directly linked to such Research and Development. Even if this is incurred either by the QFZP or is outsourced to any Person in the UAE or any Person outside the UAE, it should not be a Related Party.

Further, it cannot include Interest payments, building costs, and non-research and development costs. Where the expenditures are incurred for general and speculative R&D and cannot be identified for specific intellectual property and have a direct link, they can be divided on a pro-rata basis between the Qualifying Intellectual Property assets.

➤ Overall Expenditures: Total costs incurred, including acquisition costs, total expenditures incurred to fund research and development activities, conducted either by the Qualifying Free Zone Person or outsourced to any Person, directly connected with the creation, invention or significant development of the Qualifying Intellectual Property, including acquisition costs of the Qualifying Intellectual Property.

➤ Overall Income: Overall Income includes royalties or any other income derived from Qualifying Intellectual Property, including embedded intellectual property income derived from the sale of products and the use of processes directly related to the Qualifying Intellectual Property determined as per Article 34 of the Corporate Tax Law.

➤ Uplift Expenditures: Qualifying Expenditures are increased by 30%, but it should be up to the extent that Qualifying Expenditures, after increasing by 30%, is less than or equal to Overall Expenditures, i.e.

the sum of Qualifying Expenditures and Uplift Expenditures will be the lesser of:

i. 130% of Qualifying Expenditures, or

ii. Overall Expenditures).

Taxability of Qualifying Income from Qualifying Intellectual Property

As per the Guide issued by FTA (CTGFZP1), Qualifying Income earned from Qualifying Intellectual Property (calculated using the above formula ) will be eligible for 0% tax benefit; any income above qualifying income will be taxed at 9% without standard deduction (AED 375,000).

Tax on Income from Non-qualifying Intellectual Property - Revenue from the ownership or exploitation of intellectual property that does not qualify under the definition of Qualifying Intellectual Property will be subject to the standard 9% Corporate Tax rate.

Example

Company K (a Free Zone Person) incurs:

- Qualifying Expenditures: AED 25,000

- Uplift Expenditures: AED 7,500 (i.e., 30% of 25,000)

- Overall Expenditures: AED 100,000

- Overall Income: AED 500,000

Qualifying Intellectual Property Income

= (25,000 + 7,500)*500,000/100,000, i.e. AED 162,500 on qualifying income (AED 162,500 company can avail 0% tax benefit, and on income Excess of 162,500 i.e. AED 337,500 (500,000 minus 162,500) will be taxed @ 9%.

Whether Tax Loss of Non-Qualifying IP can offset against Qualifying Intellectual Property?

No. Tax Losses from non-qualifying Intellectual Property income cannot be offset against Qualifying Intellectual Property income. They can only be carried forward and offset against income from similar intellectual property.

Tracking System for Demonstration & Record-Keeping Requirements

To avail the benefit of 0% Corporate Tax rate, the company should be able to demonstrate the connection between Qualifying Expenditures and Qualifying Income.

Further, all the companies availing the benefit of 0% tax on the income from Qualifying Intellectual Property should maintain records to substantiate in case asked by FTA:

- Ownership and exploitation rights of Qualifying Intellectual Property

- Qualifying and Overall Expenditures incurred

- Overall Income derived from Qualifying Intellectual Property

- The Link Between Qualifying Expenditures and Qualifying Income

In case QFZP fails to maintain a tracking system, and it cannot demonstrate the link between Qualifying Income and Qualifying Intellectual Property, the 0% Corporate Tax rate will not apply.

Example

Company L, a Free Zone Person, owns two patents for plastic lids: one for coffee mugs and one for tea mugs. Since different R&D teams developed these patents, Company L must track income and expenses separately for each patent.

Taxation of income generated by a non-resident person outside UAE from Intellectual Property

Income from the use or right to use in the State, or the grant of permission to use in the State, any intellectual or intangible property. Subject income is considered as state source income as per UAE CT Law, and all state source incomes are subject to withholding tax, which is currently 0%.

To learn more about Corporate Tax on Intellectual Property in Free Zones, book a free consultation with one of the Flyingcolour team advisors.

Disclaimer: The information provided in this blog is based on our understanding of current tax laws and regulations. It is intended for general informational purposes only and does not constitute professional tax advice, consultation, or representation. The author and publisher are not responsible for any errors or omissions, or for any actions taken based on the information contained in this blog.